40.620.040 School Impact Fee Component

The impact fee component for schools shall be separately calculated for each participating school district using the following formula:

SIF = [CS (SF) – (SM) – (TC)] X A – FC

A. “SIF” means the school component of the total development impact fee.

B. “CS” means the cost of each type of facility listed in a school district’s capital facilities plan attributable to new growth divided by the number of students representing a six (6) year increase in students for each type of school facility. Each type of facility means elementary school, middle school and high school.

C. “SF” means student factor. The student factor is the number of students typically generated from one (1) residential unit for each type of school facility. This is determined by dividing the total number of residential units in a school district into the current enrollment numbers for each type of school facility.

The student factor for each school district shall be calculated annually. As provided for in Section 40.620.030(A)(5) separate student factors shall be calculated for single-family and multifamily dwelling units.

D. “SM” means state match. State match is that amount received from the state toward school construction costs.

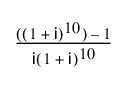

E. “TC” means tax credit. This is calculated as:

|

|

x |

Average assessed value for the dwelling unit within a school district |

x |

Current school district capital property tax levy rate |

|

|

|

|

|

|

|

where i = the average annual interest rate as stated in the Bond Buyer Twenty Bond General Obligation Bond Index. |

||||

F. “FC” means facilities credit. This is the value of any improvements listed in a school district’s capital facilities plan provided by the developer.

G. “A” means an adjustment for the portion of the anticipated increase in the public share resulting from exempt residential development pro-ratable to new residential development. This adjustment for school impact is determined to be eighty-five percent (85%).