Chapter 3.44

PARKING AND BUSINESS IMPROVEMENT AREA

Sections:

3.44.010 Creation – Boundaries.

3.44.020 Creation – Resolution of intention to establish.

3.44.040 Use of assessment revenue.

3.44.050 Payment of assessments.

3.44.060 Use of funds – Statutory authority.

3.44.010 Creation – Boundaries.

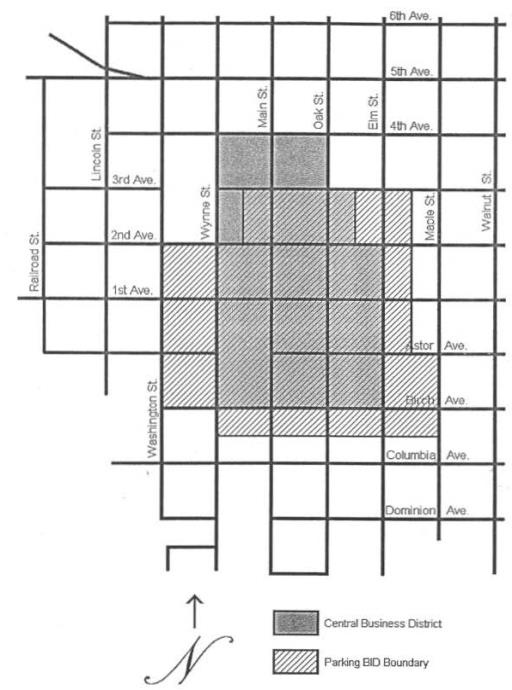

The city of Colville hereby creates a parking and business improvement area within the city limits of the city of Colville. The boundaries for said area are designated in Exhibit A.

Exhibit A

Business Improvement District Boundaries

The boundaries of the parking and business improvement district area, as established by Colville Ordinance 850 N.S. and 681 N.S. are as follows:

Starting at the center of the intersection of Washington Street at Birch Avenue, running east one block, then south 1/2 block, then east four blocks to the centerline of Maple Street, then north to the center of the intersection of Astor Avenue at Maple Street, then west 1/2 block, then north through the centerline of the alley three blocks to the centerline of Third Avenue, then west three blocks to the centerline of the alley between Main Street and Wynne Street, then south one block to the centerline of Second Avenue, then west 1 1/2 blocks to the center of the intersection of Second Avenue at Washington Street, then south three blocks to the point of beginning.

(Ord. 1296 NS § 1, 2003).

3.44.020 Creation – Resolution of intention to establish.

The parking and business improvement area is created pursuant to the “Designated Resolution of Intention to Establish a Parking and Business Improvement Area” adopted December 23, 1980. A public hearing was held December 23, 1980, at 8:00 p.m. in the City Hall, Colville, Washington, concerning formation of said area. (Ord. 1296 NS § 2, 2003).

3.44.030 Assessments.

All businesses within said area, including businesses that may in the future locate within said area, shall be subject to assessments authorized by RCW 35.87A.010. Rates of assessment shall be provided in Exhibit B at the end of this section. Within 30 days from the date they commence to do business within the boundaries of the parking and business improvement area, the owner or owners of a business shall receive a parking assessment from the Colville city treasurer in accordance with rates established in Exhibit B at the end of this section. The special assessment shall commence to accrue from the date that the business commenced to operate within the boundaries of the district.

Within 14 days following receipt of the notice from the city treasurer of the amount of the special assessment, the owner or owners of the business shall have the right to appeal the amount of the assessment by sending a written notice of appeal together with the reasons therefor, to the Colville city clerk; the appeal shall be considered at the next regular meeting of the Colville parking commission which is at least five days following the filing of the notice of appeal. A recommendation from the parking commission shall be submitted to the Colville city council within 30 days following the regular meeting. The Colville city council may establish a different base rate for the business and establish a different assessment based upon the different base rate. The actions of the Colville city council shall be final. This special assessment hereby provided for shall accrue on a month-by-month basis and shall become a lien on the business on the first day of each calendar month. At the option of the business, this special assessment may be paid on a monthly basis or by the year (in advance).

|

Central Business (C-2) Business Improvement District |

||

|

|

|

|

|

Location |

Base Rate + First 2 Employees |

3+ Employees |

|

Main Street |

$18.00 |

$3.00 each |

|

Oak Street |

$15.00 |

$3.00 each |

|

Wynne Street |

$15.00 |

$3.00 each |

|

1st Avenue |

$15.00 |

$3.00 each |

|

2nd Avenue |

$15.00 |

$3.00 each |

|

Astor Avenue |

$15.00 |

$3.00 each |

|

Birch Avenue |

$15.00 |

$3.00 each |

|

Secondary Businesses |

$15.00 |

$3.00 each |

|

Apartments |

$7.50 |

|

|

|

|

|

|

General Commercial (C-3) Business Improvement District |

||

|

|

|

|

|

Location |

Base Rate + First 2 Employees |

3+ Employees |

|

Throughout |

$7.50 |

$3.00 each |

(Ord. 1680 NS § 1, 2022; Ord. 1296 NS § 3, 2003).

3.44.040 Use of assessment revenue.

Assessment revenue shall be used for maintenance, expansion, acquisition, and development of off-street parking facilities, promote public decorations, planning, and promotional activities for the benefit of the area, provide maintenance and security for common public areas, and to provide professional management and administration associated with the business improvement area. (Ord. 1296 NS § 4, 2003).

3.44.050 Payment of assessments.

All assessments shall be paid to the city treasurer on a schedule coinciding with monthly water and sewer billing. A late fee of $5.00 per month will be assessed if payment is not made by 3:00 p.m. on the fifteenth day of the following month or the first business day thereafter. (Ord. 1536 NS § 1, 2015; Ord. 1296 NS § 5, 2003).

3.44.060 Use of funds – Statutory authority.

Funds raised pursuant to the parking and business improvement area may be used for all purposes specifically authorized in RCW 35.87A.010. (Ord. 1296 NS § 6, 2003).

3.44.070 Penalty.

In addition to whatever other penalties may be available to enforce this chapter, civil suit may be commenced in the name of the city to collect any fee or penalty due to the city including reasonable attorney’s fees and costs of suit. (Ord. 1536 NS § 2, 2015).