Chapter 3.78

MULTIFAMILY HOUSING PROPERTY TAX EXEMPTION

Sections:

3.78.030 Residential targeted area designation criteria.

3.78.040 Designated residential target areas.

3.78.050 Project eligibility standards and guidelines.

3.78.060 Application procedures.

3.78.070 Application review and issuance of conditional certificate.

3.78.080 Application for final certificate.

3.78.090 Issuance of final certificate.

3.78.100 Annual compliance review and report.

3.78.110 Cancellation of tax exemption.

3.78.120 Appeals to hearing examiner.

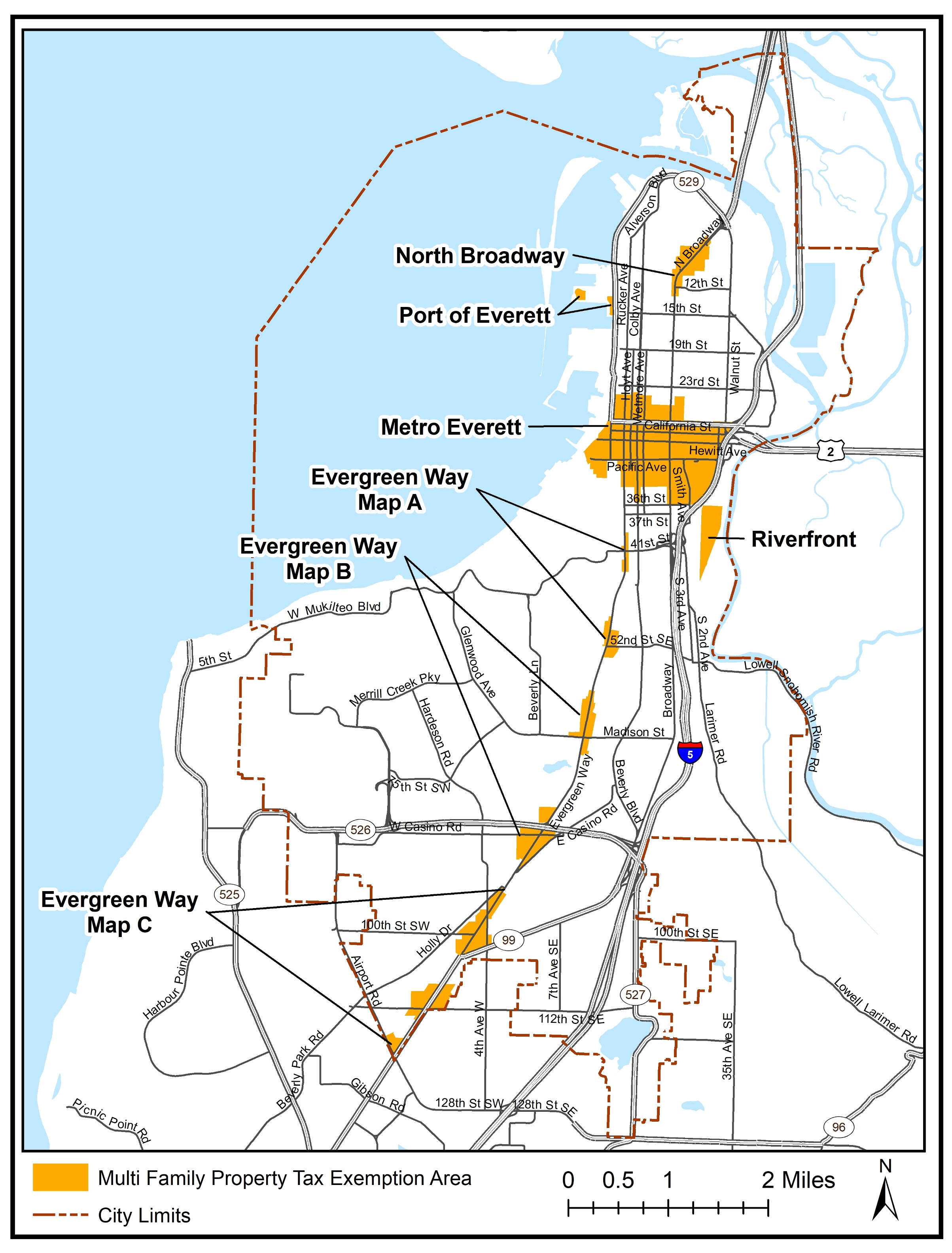

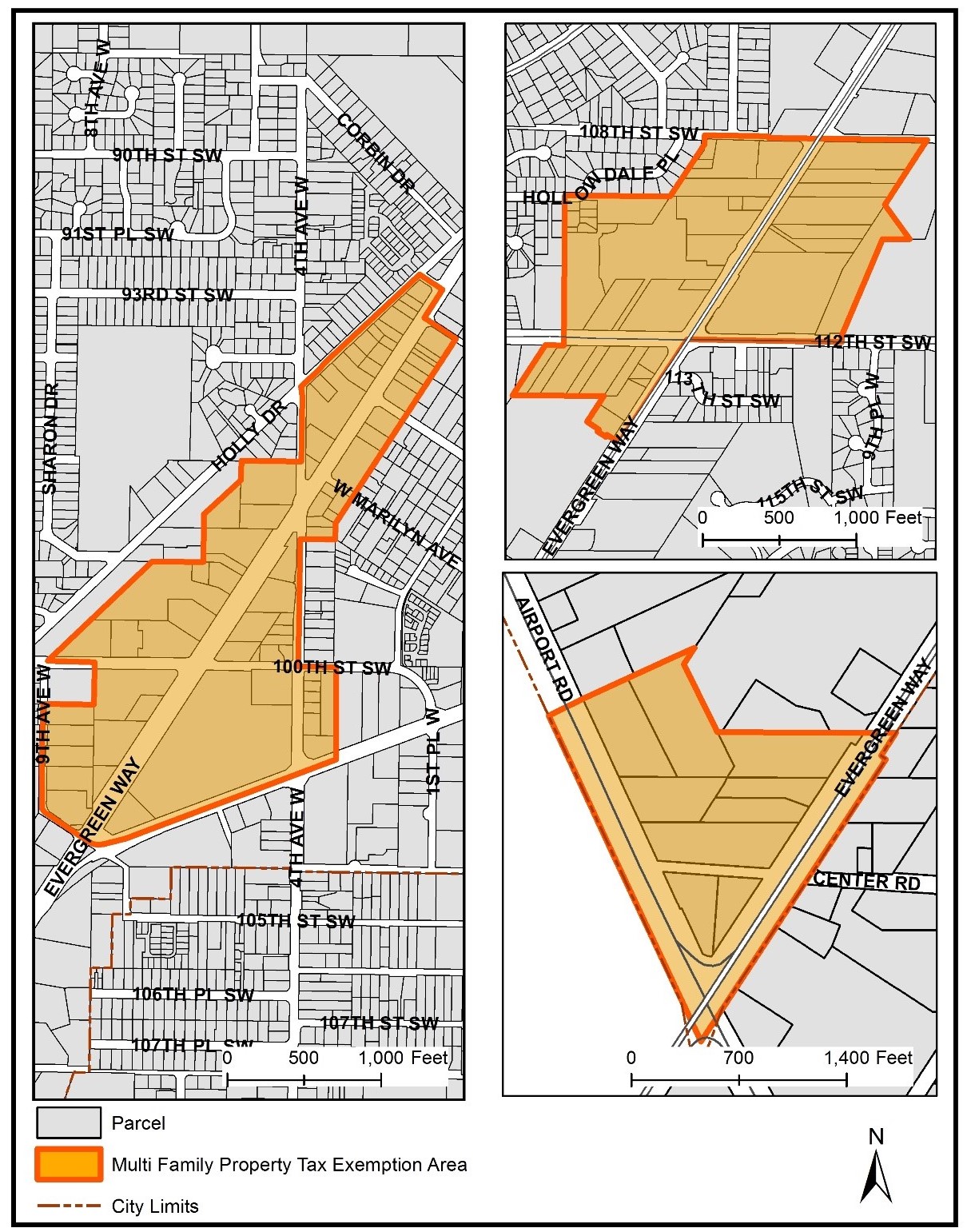

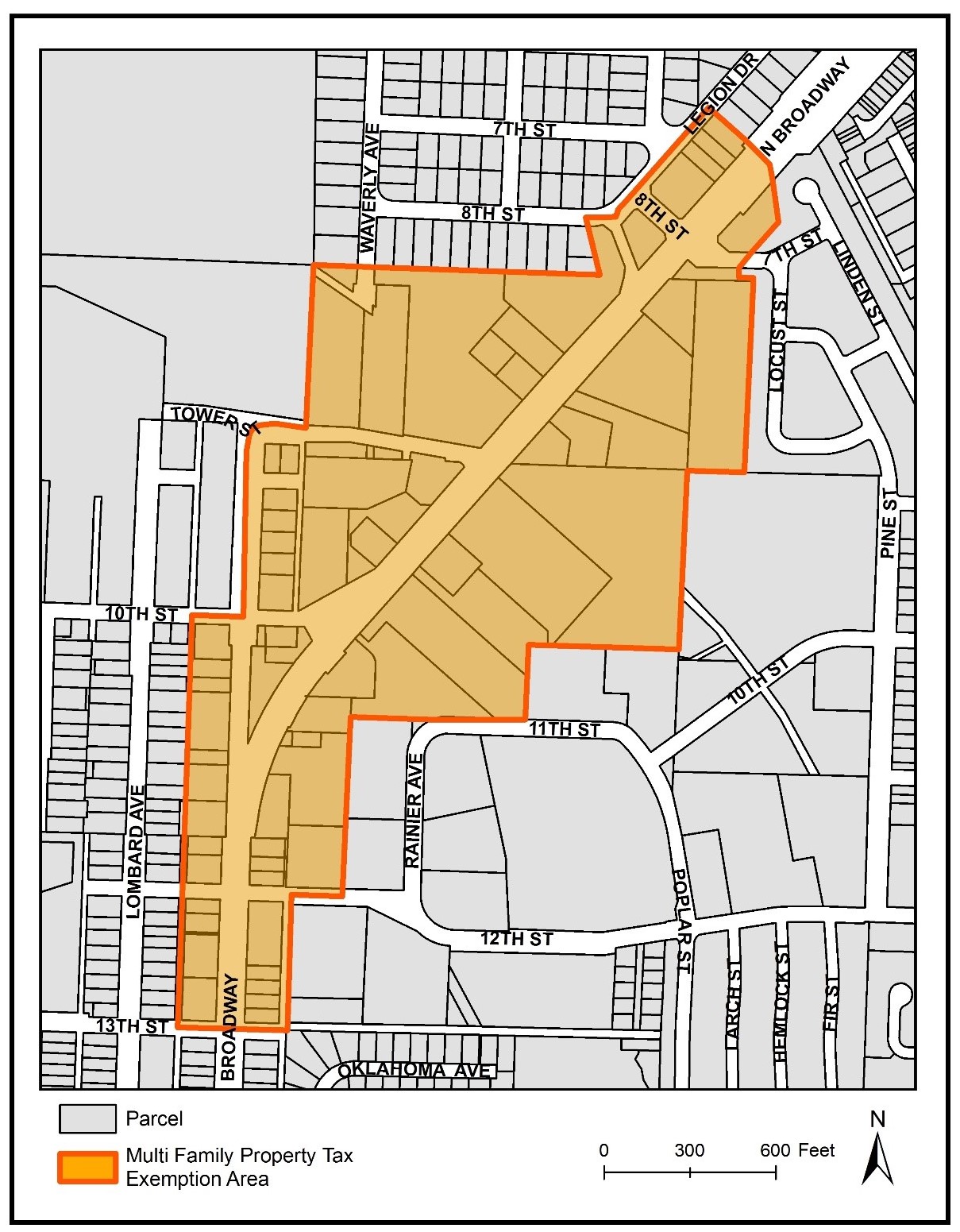

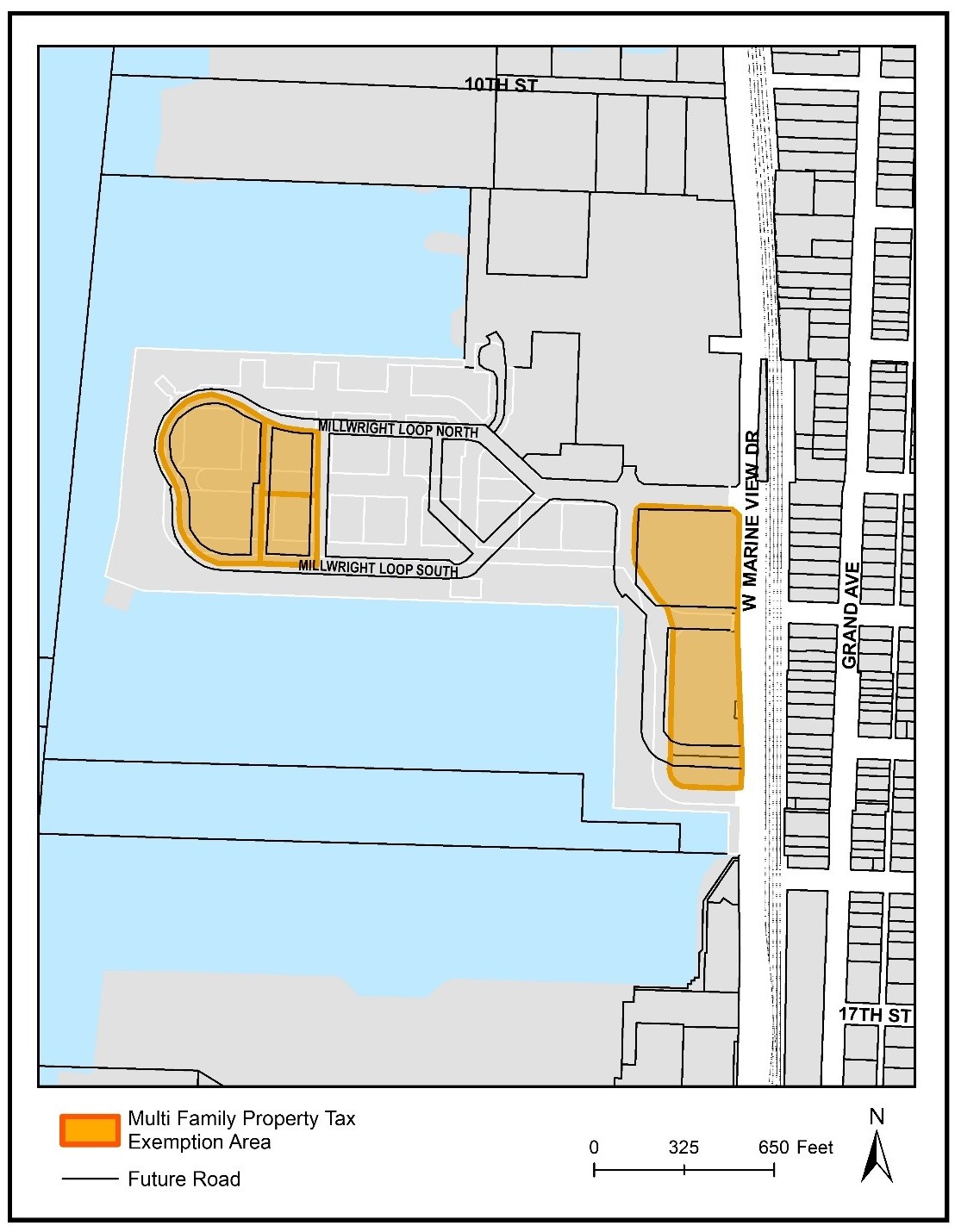

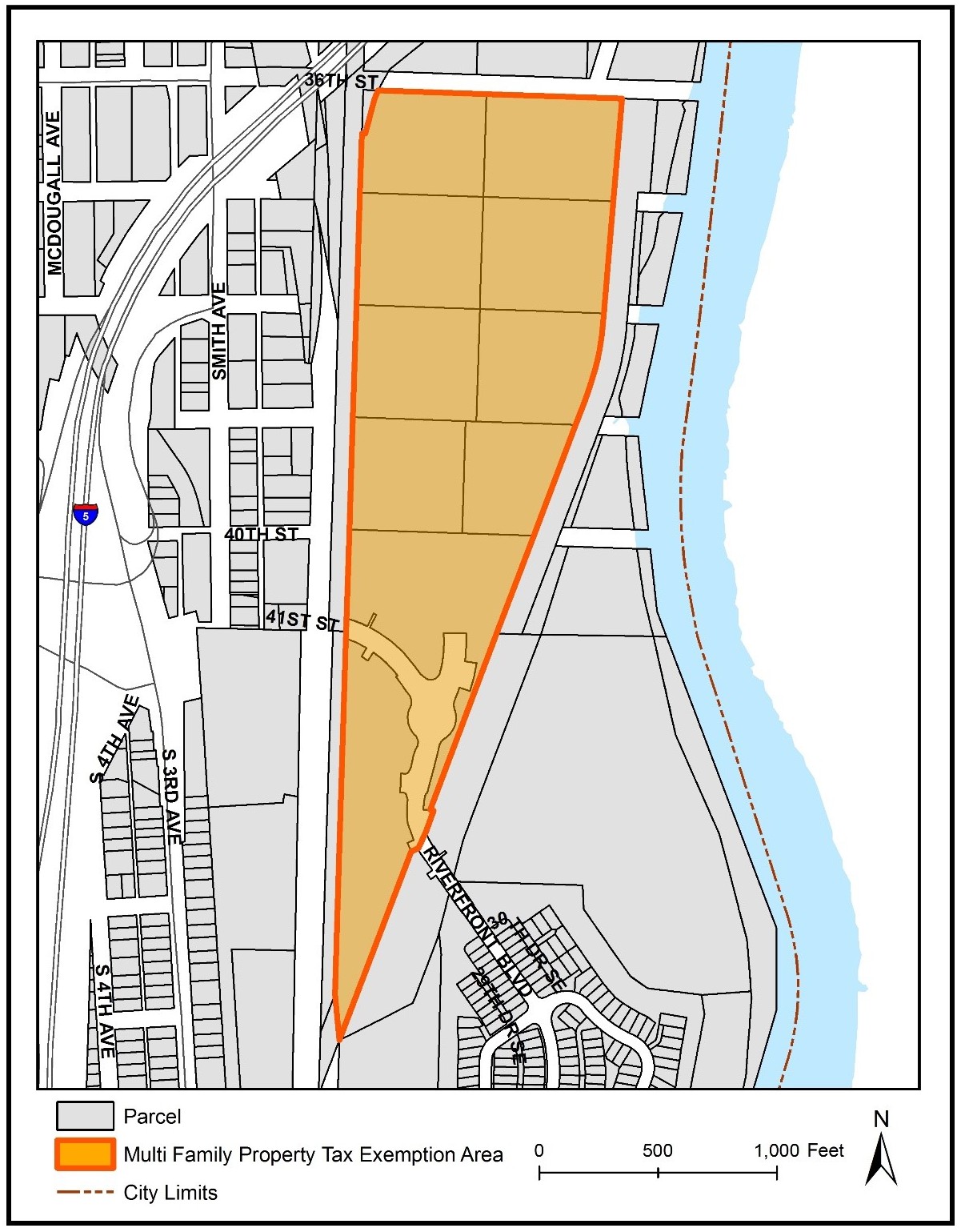

Exhibit 1 Designated residential target area maps.

3.78.010 Purpose.

It is the purpose of this chapter to encourage increased residential housing, including affordable housing opportunities, in keeping with the goals and mandates of the Growth Management Act (Chapter 36.70A RCW) so as to stimulate the construction of new multifamily housing and the rehabilitation of existing vacant and underutilized buildings for multifamily housing in the city’s urban center having insufficient housing opportunities. The tax incentive provided by Chapter 84.14 RCW will stimulate the creation of new and enhanced residential structures within the city’s urban center, benefiting and promoting the public health, safety and welfare by encouraging residential redevelopment. (Ord. 3635-18 § 2 (part), 2018)

3.78.020 Definitions.

A. “Affordable housing” means residential housing that is rented by a person or household whose monthly housing costs, including utilities other than telephone, do not exceed thirty percent of the household’s monthly income. For the purposes of housing intended for owner occupancy, “affordable housing” means residential housing that is within the means of low- or moderate-income households.

B. “High cost area” means where the third quarter median house price for the previous year as reported by the Washington Center for Real Estate Research at Washington State University for Snohomish County is equal to or greater than one hundred thirty percent of the statewide median house price published during the same time period.

C. “Household” means a single person, family, or unrelated persons living together.

D. “Local housing standard” means the International Property Maintenance Code as adopted by the city of Everett.

E. “Low-income household” means a single person, family, or unrelated persons living together whose adjusted income is at or below eighty percent of the median household income adjusted for household size for the county where the project is located, as reported by the United States Department of Housing and Urban Development. If Snohomish County is designated a high-cost area under RCW 84.14.010, “low-income household” means a household that has an income at or below one hundred percent of the median household income adjusted for household size for Snohomish County.

F. “Moderate-income household” means a single person, family, or unrelated persons living together whose adjusted income is more than eighty percent but is at or below one hundred fifteen percent of the median household income adjusted for household size for the county where the project is located, as reported by the United States Department of Housing and Urban Development. If Snohomish County is designated a high-cost area under RCW 84.14.010, “moderate-income household” means a household that is more than one hundred percent, but at or below one hundred fifty percent, of the median household income adjusted for household size for Snohomish County.

G. “Owner” means the property owner of record.

H. “Multifamily housing” and “multiple-unit housing” are used synonymously in this chapter and mean a building having the number of dwelling units specified in Section 3.78.050 that are not designed or used as transient accommodations, not including hotels and motels, and designed for permanent residential occupancy resulting from new construction, rehabilitation or conversion of a vacant, underutilized or substandard building to multifamily housing.

I. “Permanent residential occupancy” means multifamily housing that provides either owner-occupant housing or rental accommodations that are leased for a period of at least one month on a nontransient basis. This excludes accommodations that offer occupancy on a transient basis such as hotels and motels that predominately offer rental accommodations on a daily or weekly basis.

J. “Planning director” means the director of the city of Everett’s planning division of the office of community, planning and economic development or authorized designee.

K. “Rehabilitation improvements” means modifications to existing structures that are vacant for twelve months or longer that are made to achieve a condition of substantial compliance with existing building codes or modification to existing occupied structures which increase the number of multifamily housing units.

L. “Residential targeted area” means the areas within or coterminous with the city’s urban center as defined in this chapter that have been designated by the city council as the residential targeted area in accordance with this chapter and Chapter 84.14 RCW as found by the city council to be lacking sufficient available, convenient, attractive, livable, and desirable residential housing to meet the needs of the public.

M. “Urban center” means a compact identifiable district where urban residents may obtain a variety of products and services including, but not limited to, shops, offices, banks, restaurants, governmental agencies, transit service, and a mixture of uses and activities that may include housing, recreation, cultural activities, commercial or office uses. (Ord. 3635-18 § 2 (part), 2018)

3.78.030 Residential targeted area designation criteria.

Following notice and public hearing, or a continuance thereof, as prescribed in RCW 84.14.040, the city council may, in its sole discretion, designate all of or a portion of the residential targeted area described in the notice of hearing as the residential targeted area. The designated targeted area must meet the following criteria, as found by city council in its sole discretion:

A. The targeted area is located within the urban center as determined by the city council;

B. The targeted area lacks sufficient available, attractive, convenient, desirable, and livable residential housing to meet the needs of the public who would be likely to live in the urban center, if such places to live were available;

C. The providing of additional housing opportunity in the targeted area will assist in achieving the stated purposes of RCW 84.14.007, namely:

1. Encourage increased residential opportunities within the targeted area of the city of Everett; or

2. Stimulate the construction of new multifamily housing and the rehabilitation of existing vacant and underutilized buildings for multifamily housing that will increase and improve residential opportunities within the city’s urban centers;

D. In designating the residential targeted area, the city council may also consider other factors, including, but not limited to, which additional housing in the targeted area will attract and maintain a significant increase in the number of permanent residents, whether additional housing in the targeted area will help revitalize the city’s urban center, whether an increased residential population will help improve the targeted area and whether an increased residential population in the targeted area will help to achieve the planning goals mandated by the Growth Management Act under RCW 36.70A.020; and

E. The notice for the hearing has met the requirements of RCW 84.14.040. (Ord. 3635-18 § 2 (part), 2018)

3.78.040 Designated residential target areas.

The boundaries of the designated residential target areas are located within the urban centers listed below, and as indicated on the maps in Exhibit 1 of this chapter.

|

URBAN CENTER |

DESIGNATION |

|---|---|

|

Metropolitan Center |

Area 1 |

|

Evergreen Way |

Area 2 (Maps A, B and C) |

|

North Broadway |

Area 3 |

|

Waterfront Place |

Area 4 |

|

Riverfront |

Area 5 |

(Ord. 3675-19 § 1, 2019: Ord. 3635-18 § 2 (part), 2018)

3.78.050 Project eligibility standards and guidelines.

A proposed project must meet the following requirements for consideration for a property tax exemption:

A. Location. The project must be located within one of the residential target areas designated in Section 3.78.040 and Exhibit 1.

B. Size. The project must include at least eight units of multifamily housing within a residential structure or as part of a mixed-use development. A minimum of four new units must be constructed or at least four additional multifamily units must be added to existing occupied multifamily housing. Existing multifamily housing that has been vacant for twelve months or more does not have to provide additional units so long as the project provides at least four units of new, converted, or rehabilitated multifamily housing.

C. Permanent Residential Housing. At least fifty percent of the space designated for multifamily housing must be provided for permanent residential occupancy, and only that portion of the space designated for multifamily housing shall be eligible for the exemption provided for herein.

D. Tenant Displacement. If the property proposed to be rehabilitated is not vacant prior to application, an applicant must provide each existing tenant housing of comparable size, quality, and price and a reasonable opportunity to relocate.

E. Compliance with Guidelines and Standards. The project shall be designed to comply with the city’s comprehensive plan, building, housing, and zoning codes, and any other applicable regulations in effect at the time the application is approved. Rehabilitation and conversion improvements must comply with the city’s local housing standard. New construction must comply with the current building and development codes adopted by the city.

F. Affordable Housing.

1. Affordable Housing for Twelve-Year Tax Exemption. Projects which are seeking a twelve-year tax exemption shall provide twenty percent of the units as follows:

a. Area 1 (Metro Everett), Area 2 (Evergreen Way) and Area 3 (North Broadway). Projects located within these areas seeking a twelve-year tax exemption shall provide:

(1) Ten percent of the units affordable to households whose income is at or below sixty percent of the median household income adjusted for household size for Snohomish County; and

(2) Ten percent of the units affordable to households whose income is at or below eighty percent of the median household income adjusted for household size for Snohomish County.

b. Area 4 (Waterfront) and Area 5 (Riverfront). Projects located within these areas seeking a twelve-year tax exemption shall provide:

(1) Ten percent of the units affordable to low-income households; and

(2) Ten percent of the units affordable to moderate-income households.

2. Adjustment for Three-Plus Bedroom Units. The affordable housing requirement can be met for rental occupancy, either partially or fully, for any units with three or more bedrooms that are available to households whose adjusted income is at or below eighty percent of median household income adjusted for household size for Snohomish County.

3. Owner Occupancy. In the case of projects intended exclusively for owner occupancy, the affordable housing requirement means residential housing that is within the means of low- or moderate-income households.

4. The planning director is authorized to publish income and rent limits, including the use of rent and income calculators, to assist in implementation of these affordable housing requirements. (Ord. 3675-19 § 2, 2019; Ord. 3635-18 § 2 (part), 2018)

3.78.060 Application procedures.

A property owner who wishes to propose a project for a multifamily property tax exemption shall comply with the following procedures:

A. Prior to the application for any building permit, the applicant shall submit an application to the planning director, on a form established by the planning director along with required application fees.

B. A complete application shall contain such information as the planning director may deem necessary or useful, and shall include:

1. A brief written description of the project and preliminary schematic site and floor plans of the multifamily units and the structure(s) in which they are proposed to be located setting forth the grounds for the exemption;

2. A brief statement setting forth the grounds for qualification for exemption;

3. A statement from the owner acknowledging the potential tax liability when the project ceases to be eligible under this chapter; and

4. Verification by oath or affirmation of the information submitted.

For rehabilitation projects, the applicant shall also submit an affidavit that existing dwelling units have been unoccupied for a period of twelve months prior to filing the application and shall secure from the city verification of property noncompliance with the city’s local housing standard. (Ord. 3635-18 § 2 (part), 2018)

3.78.070 Application review and issuance of conditional certificate.

The planning director may certify as eligible an application which is determined to comply with the requirements of this chapter. A decision to approve or deny an application shall be made within ninety days of receipt of a complete application. An application may be approved subject to such terms and conditions as deemed appropriate by the planning director to ensure the project meets the land use regulations of the city.

A. Approval. If an application is approved by the planning director, the approval, together with a contract between the applicant and the city regarding the terms and conditions of the project, signed by the applicant, shall be signed by the planning director or designee. Once the contract is fully executed, the planning director shall issue a conditional certificate of acceptance of tax exemption. The conditional certificate expires three years from the date of approval unless an extension is granted as provided in this chapter.

B. Extension of Conditional Certificate. The conditional certificate may be extended by the planning director for a period not to exceed twenty-four consecutive months. The applicant must submit a written request stating the grounds for the extension, accompanied by a processing fee. An extension may be granted if the planning director determines that:

1. The anticipated failure to complete construction or rehabilitation within the required time period is due to circumstances beyond the control of the owner;

2. The owner has been acting and could reasonably be expected to continue to act in good faith and with due diligence; and

3. All the conditions of the original contract between the applicant and the city will be satisfied upon completion of the project.

C. Denial of Application. If the application is denied, the planning director shall state in writing the reasons for denial and shall send notice to the applicant at the applicant’s last known address within ten days of the denial. An applicant may appeal a denial to the hearing examiner by filing a written appeal within thirty days of notification by the city to the applicant the application is denied. The appeal will be based upon the record made before the planning director with the burden of proof on the applicant to show that there is no substantial evidence on the record to support the planning director’s decision. The decision of the hearing examiner in denying or approving the application is final. (Ord. 3635-18 § 2 (part), 2018)

3.78.080 Application for final certificate.

Upon completion of the improvements provided in the contract between the applicant and the city and upon issuance of a temporary or permanent certificate of occupancy, the applicant may request a final certificate of tax exemption. The applicant must file with planning director such information as the planning director may deem necessary or useful to evaluate eligibility for the final certificate and shall include:

A. A statement of expenditures made with respect to each multifamily housing unit and the total expenditures made with respect to the entire property;

B. A description of the completed work and a statement of qualification for the exemption;

C. A statement that the work was completed within the required three-year period or any authorized extension. Within thirty days of receipt of all materials required for a final certificate, the planning director shall determine whether the improvements satisfy the requirements of this chapter;

D. If applicable, a statement that the project meets the affordable housing requirements as required by this chapter. (Ord. 3635-18 § 2 (part), 2018)

3.78.090 Issuance of final certificate.

If the planning director determines that the project has been completed in accordance with the contract between the applicant and the city and has been completed within the authorized time period, the city shall, within ten days following the expiration of the thirty-day period specified in Section 3.78.080, file a final certificate of tax exemption with the Snohomish County assessor.

A. Denial and Appeal. The planning director shall notify the applicant in writing that a final certificate will not be filed if the planning director determines that:

1. The improvements were not completed within the authorized time period;

2. The improvements were not completed in accordance with the contract between the applicant and the city;

3. The owner’s property is otherwise not qualified under this chapter;

4. The owner and the planning director cannot come to an agreement on the allocation of the value of the improvements allocated to the exempt portion of rehabilitation improvements, new construction and multi-use new construction;

5. If applicable, the project does not meet the affordable housing requirements as set forth in this chapter.

B. Within thirty days of notification by the city to the owner of the planning director’s denial of a final certificate of tax exemption, the applicant may file a written appeal with the hearing examiner specifying the factual and legal basis for the appeal. (Ord. 3635-18 § 2 (part), 2018)

3.78.100 Annual compliance review and report.

A. Within thirty days after the first anniversary of the date of filing the final certificate of tax exemption and each year thereafter, for the tax exemption period, the property owner shall file a notarized declaration with the planning director indicating the following:

1. A statement of occupancy and vacancy of the multifamily units during the previous year;

2. A certification that the property continues to be in compliance with the contract with the city;

3. A description of any subsequent improvements or changes to the property; and

4. If applicable, that the property has been in compliance with the affordable housing requirements of this chapter.

City staff shall also conduct on-site verification of the declaration. Failure to submit the annual declaration may result in the tax exemption being canceled.

B. The city shall annually report by December 31st of each year to the Washington State Department of Commerce information as set forth in RCW 84.14.100(2). (Ord. 3635-18 § 2 (part), 2018)

3.78.110 Cancellation of tax exemption.

If at any time the planning director determines the owner has not complied with the terms of the contract or with the requirements of this chapter, or that the property no longer complies with the terms of the contract or with the requirements of this chapter, or for any reason no longer qualifies for the tax exemption, the tax exemption shall be canceled and additional taxes, interest and penalties imposed pursuant to state law. This cancellation may occur in conjunction with the annual review or at any other time when noncompliance has been determined. If the owner intends to convert the multifamily housing to another use, or, if applicable, the owner intends to discontinue compliance with the affordable housing requirements as required in this chapter, or any other condition to exemption, the owner must notify the planning director and the Snohomish County assessor within sixty days of the change in use or intended discontinuance. Upon such change in use or discontinuance, the tax exemption shall be canceled and additional taxes, interest and penalties imposed pursuant to state law.

A. Effect of Cancellation. If a tax exemption is canceled due to a change in use or other noncompliance, the Snohomish County assessor shall comply with applicable state law to impose additional taxes, interest and penalties on the property, and a priority lien may be placed on the land, pursuant to state law.

B. Notice and Appeal. Upon determining that a tax exemption is to be canceled, the planning director shall notify the property owner by certified mail, return receipt requested. The property owner may appeal the determination by filing a notice of appeal with the hearing examiner within thirty days, specifying the factual and legal basis for the appeal. The hearing examiner will conduct a hearing at which the applicant and the city will be heard and all competent evidence received. The hearing examiner will affirm, modify, or repeal the decision to cancel the exemption based on the evidence received. (Ord. 3635-18 § 2 (part), 2018)

3.78.120 Appeals to hearing examiner.

A. The city’s land use hearing examiner is hereby provided jurisdiction to hear appeals of the decisions of the planning director under this chapter. Said appeals shall be as follows:

1. Appeal of a decision of the planning director that the owner is not entitled to a final certificate of tax exemption, filed within thirty days of notification by the city to the owner of denial of a final certificate of tax exemption.

2. Appeal of a cancellation of tax exemption, filed within thirty days of the notification by the city to the owner of cancellation.

B. The hearing examiner’s procedures shall apply to hearings under this chapter to the extent they are consistent with the requirement of this chapter and Chapter 84.14 RCW. The hearing examiner shall give substantial weight to the planning director’s decision and the burden of overcoming the weight shall be on the appellant. The decision of the examiner constitutes the final decision of the city. An aggrieved party may appeal the decision to superior court under RCW 34.05.510 through 34.05.598 if the appeal is properly filed within thirty days of notification by the city to the appellant of that decision. (Ord. 3635-18 § 2 (part), 2018)

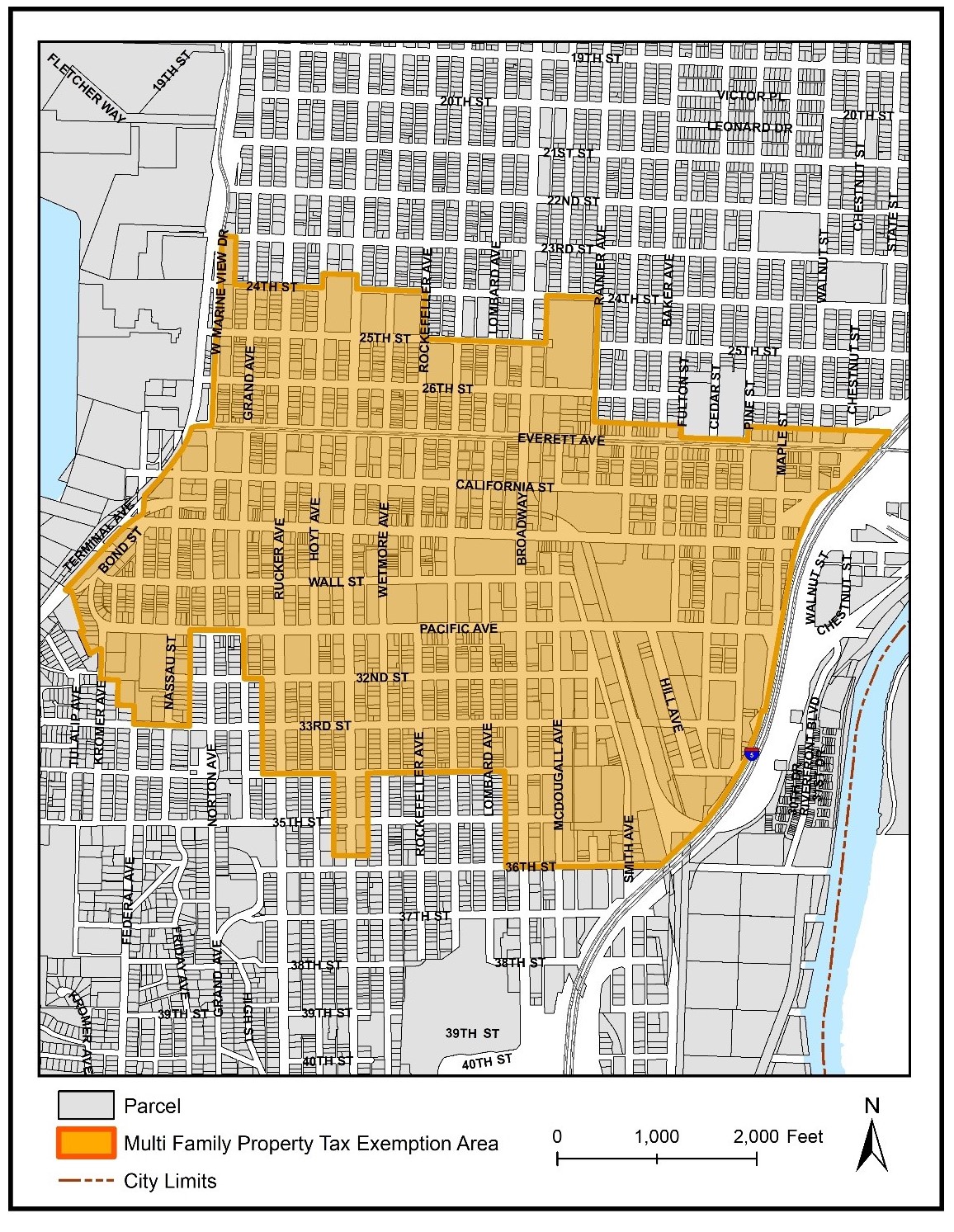

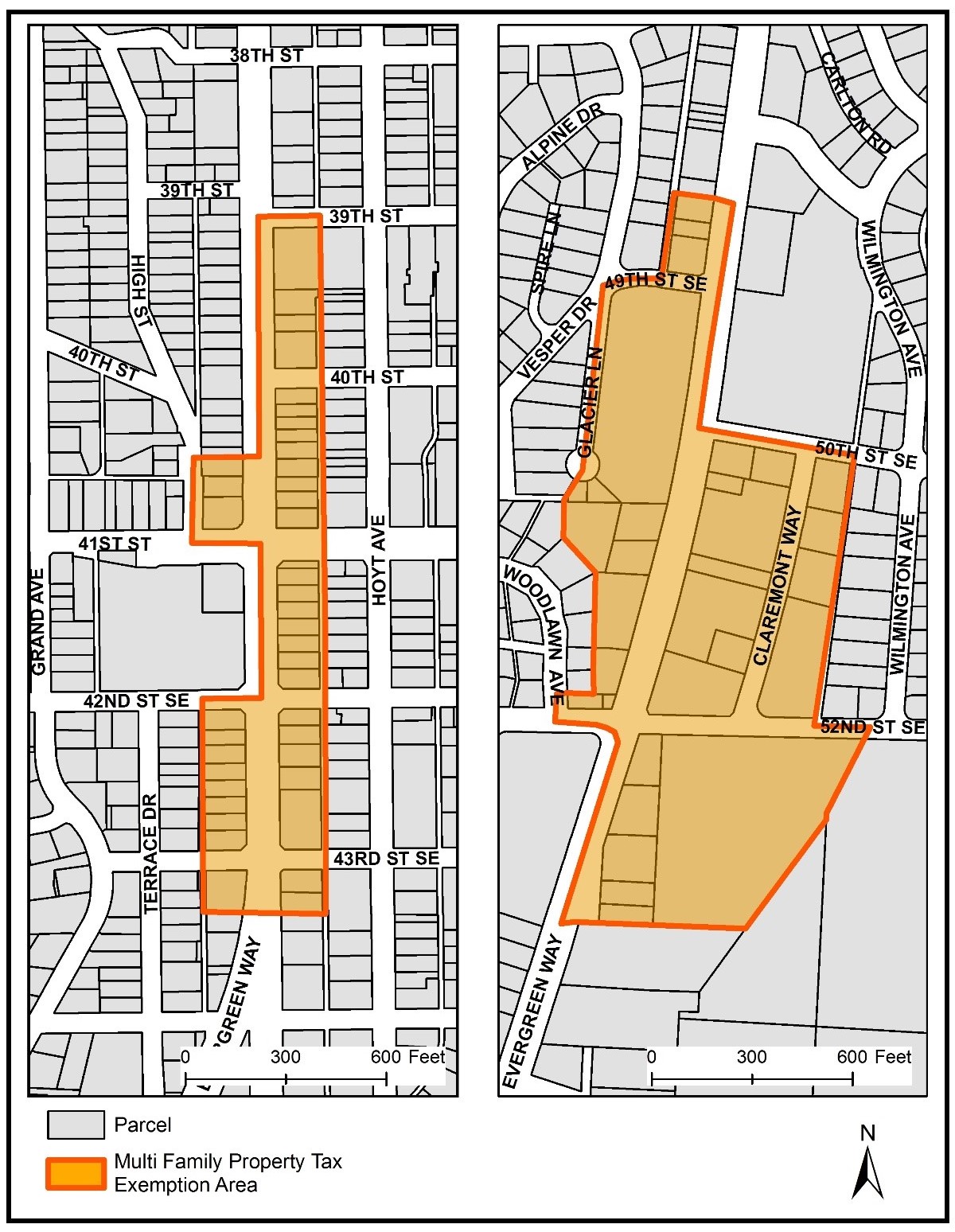

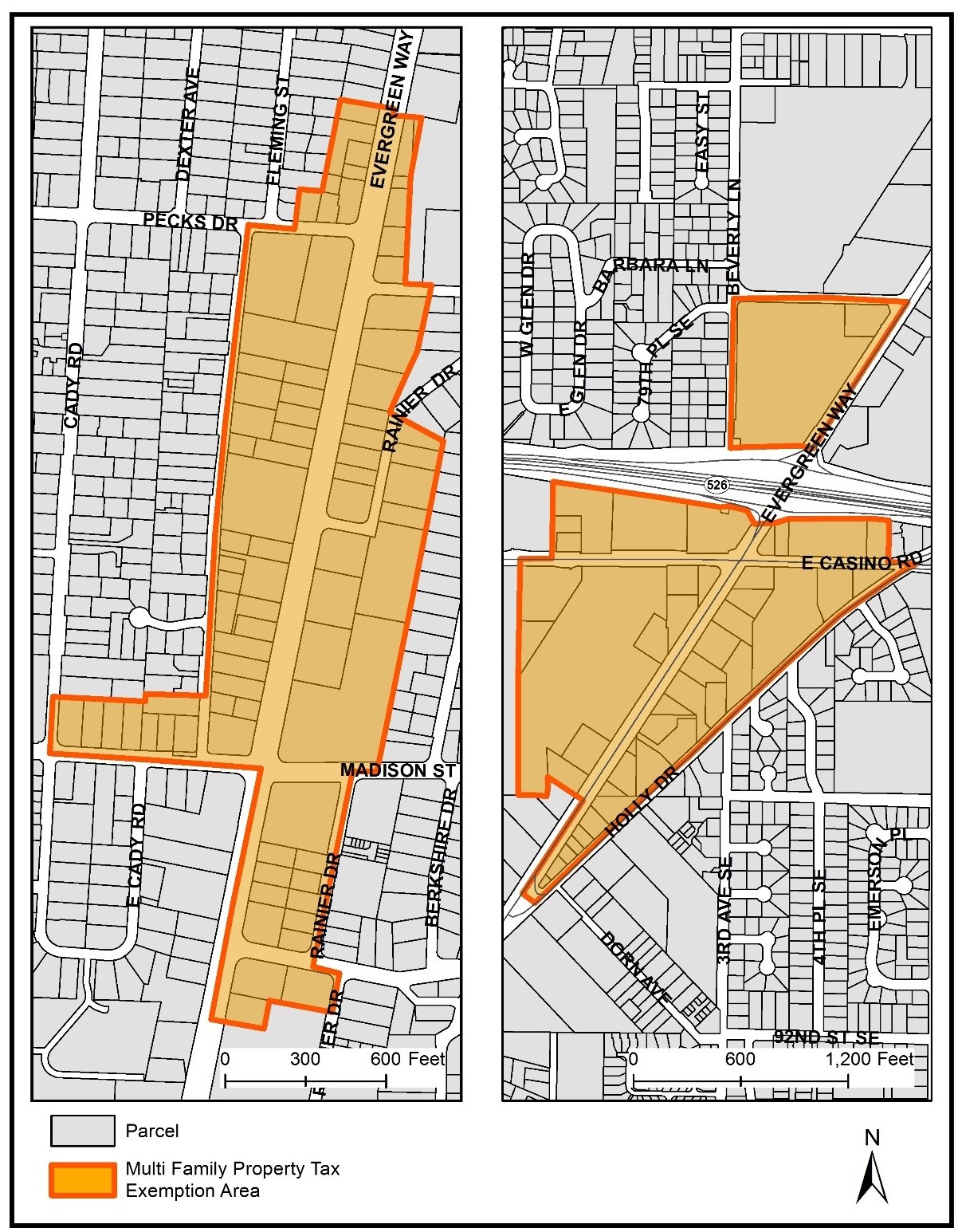

Exhibit 1 Designated residential target area maps.

Area 1, Metropolitan Center

Area 2, Evergreen Way, Map A

Area 2, Evergreen Way, Map B

Area 2, Evergreen Way, Map C

Area 3, North Broadway

Area 4, Waterfront Place

Area 5, Riverfront

(Ord. 3675-19 § 3, 2019; Ord. 3635-18 (Exh. 1), 2018)