Chapter 15.04

GENERAL PROVISIONS GOVERNING THE ASSESSMENT OF IMPACT FEES

Sections:

15.04.010 Findings and authority.

15.04.020 Definitions.

15.04.030 Findings of concurrency.

15.04.040 Assessment of impact fees.

15.04.050 Independent Fee Calculations.

15.04.060 Exemptions.

15.04.070 Credits.

15.04.080 Tax adjustments.

15.04.090 Appeals.

15.04.100 Establishment of impact fee accounts for parks and transportation.

15.04.110 Authorization for the school interlocal agreement and the establishment of the school impact account.

15.04.120 Refunds.

15.04.130 Use of funds.

15.04.140 Administrative guidelines.

15.04.150 Review.

15.04.010 - Findings and authority

The City Council of the City of Olympia (the "Council") hereby finds and determines that new growth and development, including but not limited to new residential, commercial, retail, office, and industrial development, in the City of Olympia will create additional demand and need for public facilities in the City of Olympia, and the Council finds that new growth and development should pay a proportionate share of the cost of new facilities needed to serve the new growth and development. The City of Olympia has conducted extensive studies documenting the procedures for measuring the impact of new developments on public facilities, has prepared the Parks Study and the Transportation Study and has reviewed the Schools Study prepared by the Olympia School District No. 111 ("District No. 111"), and hereby incorporates these studies into this title by reference. Therefore, pursuant to Chapter 82.02 RCW, the Council adopts this title to assess impact fees for parks, transportation facilities, and schools. The provisions of this title shall be liberally construed in order to carry out the purposes of the Council in establishing the impact fee program.

(Ord. 6607 §1, 2008; Ord. 6164 §1, 2001; Ord. 5490 §1, 1994).

15.04.020 - Definitions

The following words and terms shall have the following meanings for the purposes of this title, unless the context clearly requires otherwise. Terms otherwise not defined herein shall be defined pursuant to RCW 82.02.090, or given their usual and customary meaning.

A. "Act" means the Growth Management Act, as codified in RCW 36.70A, as now in existence or as hereafter amended.

B. "Accessory Dwelling Unit" means a dwelling unit that has been added onto, created within, or separated from a single-family detached dwelling for use as a complete independent living unit with provisions for cooking, eating, sanitation, and sleeping.

C. "Building Permit" means an official document or certification which is issued by the Building Official and which authorizes the construction, alteration, enlargement, conversion, reconstruction, remodeling, rehabilitation, erection, demolition, moving or repair of a building or structure.

D. "Capital Facilities" means the facilities or improvements included in a capital budget.

E. "Capital Facilities Plan" means the capital facilities plan element of a comprehensive plan adopted by the City of Olympia pursuant to Chapter 36.70A RCW, and such plan as amended.

F. "City" means the City of Olympia.

G. "Council" means the City Council of the City of Olympia.

H. "Concurrent" or "Concurrency" means that the improvements are in place at the time the impacts of development occur, or that the necessary financial commitments are in place, which shall include the impact fees anticipated to be generated by the development, to complete the improvements necessary to meet the specified standards of service defined in the Parks Study, the Transportation Study, and the Schools Study within six (6) years of the time the impacts of development occur.

I. "County" means Thurston County.

J. "Department" means the Department of Community Planning and Development.

K. "Development Activity" means any construction, expansion, or change in the use of a building or structure that creates additional demand and need for public facilities.

L. "Development Approval" means any written authorization from the City of Olympia which authorizes the commencement of a development activity.

M. "Director" means the Director of the Department of Community Planning and Development or the Director’s designee.

N. "District No. 111" means the Olympia School District No. 111, Thurston County, Washington.

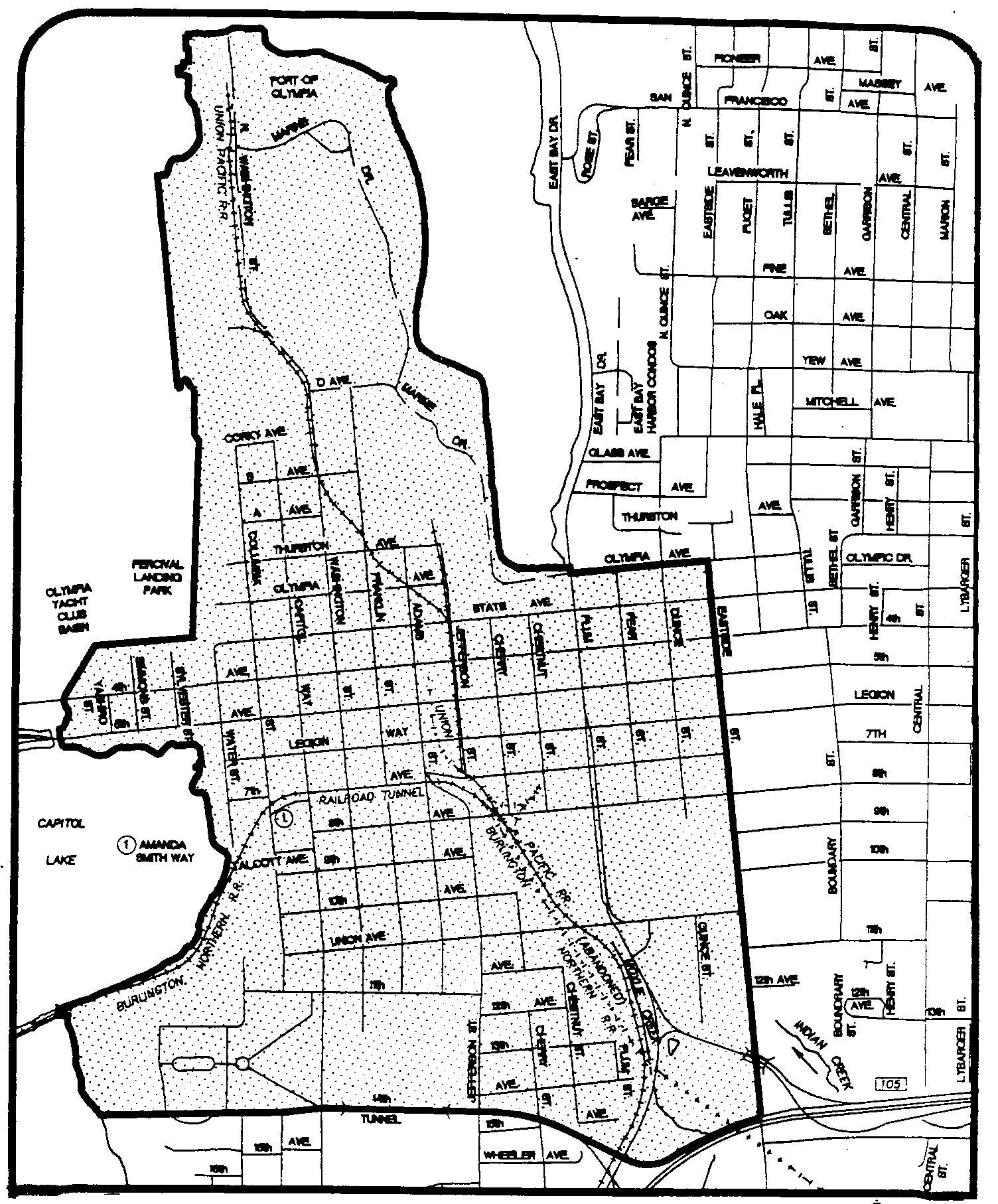

O. "Downtown Impact Fee Payment Area" means all properties located within the downtown area, which is currently bounded by: Budd Inlet on the north; Budd Inlet and Capitol Lake on the west; along 14th Avenue extending between Capitol Lake and Capitol Way, then east on 14th Avenue extending to Interstate 5 on the south; Eastside Street on the east; and along Olympia Avenue in a westerly direction reconnecting with the Budd Inlet on the north, including properties owned by the Port of Olympia, as shown in Figure 15-04-1.

P. "Dwelling Unit" means a single unit providing complete and independent living facilities for one or more persons, including permanent facilities for living, sleeping, eating, cooking, and sanitation needs.

Q. "Elderly" means a person aged 62 or older.

R. "Encumbered" means to reserve, set aside, or otherwise earmark the impact fees in order to pay for commitments, contractual obligations, or other liabilities incurred for public facilities.

S. "Feepayer" is a person, corporation, partnership, an incorporated association, or any other similar entity, or department or bureau of any governmental entity or municipal corporation commencing a land development activity which creates the demand for additional capital facilities, and which requires the issuance of a building permit. "Feepayer" includes an applicant for an impact fee credit.

T. "Gross Floor Area" means the total square footage of any building, structure, or use, including accessory uses.

U. "Hearing Examiner" means the Examiner who acts on behalf of the Council in considering and applying land use regulatory codes as provided under Chapter 18.71 of the Olympia Municipal Code. Where appropriate, "Hearing Examiner" also refers to the office of the hearing examiner.

V. "Impact fee" means a payment of money imposed by the City of Olympia on development activity pursuant to this title as a condition of granting development approval in order to pay for the public facilities needed to serve new growth and development. "Impact fee" does not include a reasonable permit fee, an application fee, the administrative fee for collecting and handling school impact fees, or the cost of reviewing independent fee calculations.

W. "Impact Fee Account" or "Account" means the account(s) established for each type of public facility for which impact fees are collected. The Accounts shall be established pursuant to Sections 15.04.100 and 15.04.110 of this title, and comply with the requirements of RCW 82.02.070.

X. "Independent Fee Calculation" means the park impact calculation, the school impact calculation, the transportation calculation, and/or economic documentation prepared by a feepayer, to support the assessment of an impact fee other than by the use of Schedules A, C and D of Chapter 15.16, or the calculations prepared by the Director or District No. 111 where none of the fee categories or fee amounts in the schedules in Chapter 15.16 accurately describe or capture the impacts of the new development on public facilities.

Y. "Interest" means the average interest rate earned by the City of Olympia or District No. 111 with respect to school fees in the last fiscal year, if not otherwise defined.

Z. "Interlocal Agreement" or "Agreement" means the school interlocal agreement by and between the City of Olympia and District No. 111 as authorized in Section 15.04.110 herein.

AA. "Occupancy Permit" means the permit issued by the City of Olympia where a development activity results in a change in use of a pre-existing structure.

BB. "Open Space" means for the purposes of this title undeveloped public land that is permanently protected from development (except for the development of trails or other passive public access or use).

CC. "Owner" means the owner of record of real property, or a person with an unrestricted written option to purchase property; provided that, if the real property is being purchased under a recorded real estate contract, the purchaser shall be considered the owner of the real property.

DD. "Parks" means parks, open space, and recreational facilities, including but not limited to ball fields, golf courses, athletic fields, soccer fields, swimming pools, tennis courts, volleyball courts, neighborhood parks, community parks, special use parks, trails, and open space.

EE. "Parks Study" means the Rate Study for Impact Fees for Park Land July 23, 2007 and as may be amended in the future.

FF. "Planned Residential Development" or "PRD" shall have the same meaning as set forth in Chapter 18.56 of the Olympia Municipal Code.

GG. "Project Improvements" mean site improvements and facilities that are planned and designed to provide service for a particular development or users of the project, and are not system improvements. No improvement or facility included in a capital facilities plan adopted by the Council shall be considered a project improvement.

HH. "Public Facilities" means the following capital facilities owned or operated by the City of Olympia or other governmental entities: (1) publicly owned parks, open space, and recreational facilities; (2) public streets, and roads; and (3) public school facilities.

II. "Residential" or "Residential Development" means all types of construction intended for human habitation. This shall include, but is not limited to, single-family, duplex, triplex, and other multifamily development.

JJ. "Schools Study" means the "Olympia School District - Rate Study for Impact Fees for School Facilities, 1994," and as may be amended in the future.

KK. "Single Room Occupancy Dwelling" means a housing type consisting of one room, often with cooking facilities and with private or shared bathroom facilities.

LL. "Square Footage" means the square footage of the gross floor area of the development.

MM. "State" means the State of Washington.

NN. "System Improvements" means public facilities that are included in the City of Olympia’s capital facilities plan and are designed to provide service to service areas within the community at large, in contrast to project improvements.

OO. "Transportation Study" means the City of Olympia Transportation Impact Fee Program Update dated December 2008, and as may be amended in the future.

(Ord. 6649 §1, 2009; Ord. 6607 §1, 2008; Ord. 6516 §2, 2007; Ord. 6410 §1, 2006; Ord. 6224 §1, 2002; Ord. 6164 §1, 2001; Ord. 5785 §1, 1998; Ord. 5490 §2, 1994).

15.04.030 - Findings of concurrency

A. Prior to approving proposed subdivisions, dedications, short plats, short subdivisions, planned residential developments, or binding site plans, the Council or administrative personnel shall make written findings that the public facilities which will be needed as a result of the new development, such as parks, recreation, open space, schools, and school grounds, will be provided concurrent with development. The concurrency requirement is satisfied if the improvements are in place at the time the impacts of development occur, or that the necessary financial commitments are in place, which shall include the impact fees anticipated to be generated by the development, to complete the improvements required to meet the specified standards of service defined in the Parks Study and the Schools Study within six (6) years of the time that the impacts of development occur. Any combination of the following shall constitute the "necessary financial commitments" for the purposes of this title:

1. The City or District No. 111 has received voter approval of and/or has bonding authority;

2. The City or District No. 111 has received approval for federal, state or other funds;

3. The City or District No. 111 has received a secured commitment from a feepayer that the feepayer will construct the needed improvement(s) or facility and the City or District No. 111 has found such improvement(s) or facility to be acceptable and consistent with its capital facilities plan; and/or

4. The City or District No. 111 has other assured funding, including but not limited to impact fees which have been paid.

B. Compliance with this concurrency requirement shall be sufficient to satisfy the provisions of RCW 58.17.110, RCW 58.17.060, and the Act. The finding of concurrency shall be made at the time of preliminary plat or PRD approval or at the time of binding site plan approval.

C. The City shall not approve applications for preliminary plats, PRDs, or binding site plans, unless the City is able to make a finding of concurrency; provided that, if the feepayer opts to dedicate land, to provide improvements, and/or construction consistent with the requirements of Section 6 of this title governing credits, where appropriate, the City can make a finding of concurrency.

D. A finding of concurrency provided to the applicant at the time of preliminary plat or PRD approval, or at the time of binding site plan approval, shall be valid for a period of three (3) years from the date of receipt. If pursuant to law, an applicant requests an extension of the three-year period between the date of preliminary and final plat or PRD approval, the applicant shall be subject to a new concurrency determination prior to the granting of a request for an extension.

E. If any party for any reason is able to exempt itself from the operation of this title, the City reserves the right to review its land use plan in conjunction with its capital facilities plan in order to ensure concurrency. In the event that the impact fees that might have been paid would have been an integral part of the financing to ensure concurrency, the City reserves the right to deny approval for the development on these grounds.

(Ord. 6607 §1, 2008; Ord. 5490 §3, 1994).

15.04.040 - Assessment of impact fees

A. The City shall collect impact fees, based on the schedules in Chapter 15.16, or an independent fee calculation as provided for in Chapter 15.04.050, from any applicant seeking development approval from the City for any development activity within the City, where such development activity requires the issuance of a building or occupancy permit. This shall include, but is not limited to, the development of residential, commercial, retail, office, and industrial land, and includes the expansion of existing uses that creates a demand for additional public facilities, as well as a change in existing use that creates a demand for additional public facilities.

B. Applicants seeking development approval from the City for residential developments where the property is located outside the boundaries of District No. 111 shall not be required to pay the school impact fee set forth in Schedule C (Section 15.16.030) of Appendix A (Chapter 15.16).

C. Where a change in use triggers review under the State Environmental Policy Act or increases the trip generation by more than 5% or ten peak hour trips, whichever is less, the Director shall calculate a transportation impact fee based on the increases in the trip generation rate.

D. Impact fees shall be assessed at the time the complete building permit application is submitted for each unit in the development, using either the impact fee schedules then in effect or an independent fee calculation, at the election of the applicant and pursuant to the requirements set forth in Section 15.04.050. The City shall not accept an application for a building permit if final plat, PRD, or binding site plan approval is needed and has not yet been granted by the City. Furthermore, the City shall not accept an application for a building permit unless prior to submittal or concurrent with submittal, the feepayer submits complete applications for all other discretionary reviews needed, including, but not limited to, design review, the environmental determination, and the accompanying checklist.

E. Applicants that have been awarded credits prior to the submittal of the complete building permit application pursuant to Section 15.04.070, shall submit, along with the complete building permit application, a copy of the letter or certificate prepared by the Director pursuant to Section 15.04.070 setting forth the dollar amount of the credit awarded. Impact fees, as determined after the application of appropriate credits, shall be collected from the feepayer at the time the building permit is issued or prior to final building inspection as set forth in Subsection (H) below.

F. Where the impact fees imposed are determined by the square footage of the development, the impact fee shall be based on the size and type of structure proposed to be constructed on the property. If the final square footage of the development is in excess of the initial square footage set forth in the building permit, any difference will be adjusted at the time that a certificate of occupancy is issued or the time that the building is occupied, using the rate schedule in effect at that time of permit application.

G. Except as provided in subsection (H) below, the Department shall not issue a building permit unless and until the impact fees required by this Chapter, less any permitted exemptions, credits or deductions, have been paid.

H. Impact fee payments may be deferred until prior to the City conducting a final building inspection. All applicants and/or legal owners of the property upon which the development activity allowed by the building permit is to occur must sign an Impact Fee Deferral Agreement in a form acceptable by the City Attorney. The applicant will pay a $50 administrative fee, along with fees necessary for recording the agreement in the office of the Thurston County Auditor.

In the event that the fees are not paid within the time provided in this subsection, the City shall institute foreclosure proceedings under the process set forth in Chapter 61.12 RCW, except as revised herein. The then-present owner shall also pay the City’s reasonable attorney fees and costs incurred in the foreclosure process. Notwithstanding the foregoing, the City shall not commence foreclosure proceedings less than thirty (30) calendar days prior to providing written notification to the then-present owner of the property via certified mail with return receipt requested advising of its intent to commence foreclosure proceedings. If the then-present owner cures the default within the thirty-day cure period, no attorney fees and/or costs will be owed.

The deferred payment option set forth in this subsection shall terminate on August 1, 2011, unless otherwise re-authorized by the City Council.

FIGURE 15-04-1

Downtown Deferred Impact Fee Payment Option Area

(Grey Shaded Area Only)

Note: This map is for illustrative purposes only.

For exact description of area, see Section 15.04.020 Definitions.

(Ord. 6649 §2, 2009; Ord. 6607 §1, 2008; Ord. 6420 §6, 2006; 6302 §1, 2004; Ord. 6224 §2, 2002; Ord 6164 §1, 2001; Ord. 5785 §2, 1998; Ord. 5490 §4, 1994).

15.04.050 - Independent fee calculations

A. If in the judgment of the Director, none of the fee categories or fee amounts set forth in Schedule A or D (Sections 15.16.010 or 15.16.040) accurately describe or capture the impacts of a new development on parks or transportation facilities, the Department may prepare independent fee calculations and the Director may impose alternative fees on a specific development based on those calculations. The alternative fees and the calculations shall be set forth in writing and shall be mailed to the feepayer. For example, with respect to group homes, the fees imposed shall take into account the size and number of residents proposed to be housed in such group homes, and the Director shall determine the fees to be imposed based on the Director’s judgment of the approximate equivalent number of residents that would be generated compared to single family dwelling units.

B. If District No. 111 believes in good faith that none of the fee categories or fee amounts set forth in Schedule C (Section 15.16.030) accurately describe or capture the impacts of a new development on schools, District No. 111 may conduct independent fee calculations and submit such calculations to the Director. The Director may impose alternative fees on a specific development based on the calculations of District No. 111, or may impose alternative fees based on the calculations of the Department. The alternative fees and the calculations shall be set forth in writing and shall be mailed to the feepayer.

C. An applicant may elect to have impact fees determined according to Schedule A, B, or D (Sections 15.16.010 and .040, respectively). If the applicant does so, s/he shall execute an agreement in a form satisfactory to the City Attorney waiving the applicant’s right to an independent fee calculation provided for in this Section. In the alternative, if an applicant opts not to have the impact fees determined according to Schedule A or D (Sections 15.16.010 or 15.16.040), the applicant may elect an independent fee calculation for the development activity for which a building permit is sought. In that event, the applicant may prepare and submit his/her own independent fee calculation, or may request that the City prepare an independent fee calculation. The applicant must make the election between fees calculated under Schedules A or D and an independent fee calculation prior to issuance of the building permit for the development. If the applicant elects to prepare his/her own independent fee calculation, the applicant must submit documentation showing the basis upon which the independent fee calculation was made.

D. An applicant may elect to have impact fees determined according to Schedule C (Section 15.16.030). If the applicant does so, s/he shall execute an agreement in a form satisfactory to the City Attorney waiving the applicant’s right to an independent fee calculation provided for in this Section. In the alternative, if an applicant opts not to have the impact fees determined according to Schedule C (Section 15.16.030), the applicant may elect an independent fee calculation for the development activity for which a building permit is sought. In that event, the applicant may prepare and submit his/her own independent fee calculation, or may request that the City prepare an independent fee calculation. The applicant must make the election between fees calculated under Schedule C and an independent fee calculation prior to issuance of the building permit for the development. If the applicant elects to prepare its own independent fee calculation, the applicant must submit documentation showing the basis upon which the independent fee calculation was made. The Director shall provide District No. 111 an opportunity to review the independent fee calculation and provide an analysis to the Director concerning whether the independent fee calculation should be accepted, rejected, or accepted in part. The Director may adopt, reject, or adopt in part the independent fee calculation based on the analysis prepared by District No. 111, or may impose alternative fees based on the calculations of the Department, the feepayer’s independent fee calculation, the specific characteristics of the development, and/or principles of fairness. The fees or alternative fees and the calculations shall be set forth in writing and shall be mailed to the feepayer, and with respect to school impact fees, to the Superintendent or his/her designee of District No. 111.

E. Any applicant electing an independent fee calculation shall be required to pay the City of Olympia a fee to cover the cost of reviewing or preparing the independent fee calculation, as follows: If the applicant elects to submit his/her own independent fee calculation, the applicant shall pay to the City at the time of the independent fee calculation election a fee of five hundred dollars ($500.00) plus a deposit of five hundred dollars ($500.00) towards the City’s actual costs incurred in reviewing the independent fee calculation. The applicant shall remit all remaining actual costs of the City’s review of the independent fee calculation prior to and as a precondition of the City’s issuance of the building permit. If the City’s actual costs are lower than the deposit amount, the difference shall be remitted to the applicant. If the applicant elects to have the City prepare the independent fee calculation, the applicant shall pay to the City at the time of the independent fee calculation election a fee of five hundred dollars ($500.00).

F. While there is a presumption that the calculations set forth in the Parks Study, the Schools Study, and the Transportation Study are valid, the Director shall consider the documentation submitted by the feepayer and the analysis prepared by District No. 111, but is not required to accept such documentation or analysis which the Director reasonably deems to be inaccurate or not reliable, and may modify or deny the request, or, in the alternative, require the feepayer or District No. 111 to submit additional or different documentation for consideration. The Director is authorized to adjust the impact fees on a case-by-case basis based on the independent fee calculation, the specific characteristics of the development, and/or principles of fairness. The Director’s decision shall be set forth in writing and shall be mailed to the feepayer, and with respect to school impact fees, to the Superintendent or his/her designee of District No. 111.

G. Determinations made by the Director pursuant to this Section may be appealed to the office of the hearing examiner subject to the procedures set forth in OMC Chapter 18.75.

(Ord. 6607 §1, 2008; Ord. 6302 §2, 2004; Ord. 6164 §1, 2001).

15.04.060 - Exemptions

A. The following shall be exempted from the payment of impact fees as follows:

1. Alteration of an existing nonresidential structure that does not expand the usable space or add any residential units shall be exempt from paying all impact fees;

2. Miscellaneous improvements, including, but not limited to, fences, walls, swimming pools, and signs shall be exempt from paying all impact fees;

3. Demolition or moving of a structure shall be exempt from paying all impact fees;

4. Expansion of an existing structure that results in the addition of one hundred twenty (120) square feet or less of gross floor area shall be exempt from paying all impact fees;

5. Replacement of a structure with a new structure of the same size and use at the same site or lot when such replacement occurs within seventy-two (72) months of the demolition or destruction of the prior structure shall be exempt from paying all impact fees. Replacement of a structure with a new structure of the same size shall be interpreted to include any structure for which the gross square footage of the building will not be increased by more than one hundred twenty (120) square feet. Such replacements shall be exempt from the payment of park, transportation impact fees, and school impact fees; provided that, park, transportation, and school impact fees will be charged for any additional residential units that are created in the replacement and, transportation impact fees shall be charged for any additional gross floor area greater than one hundred twenty (120) square feet added in the replacement;

6. Any form of housing intended for and solely occupied by persons 62 years or older, including nursing homes and retirement centers, shall be exempt from the payment of park and school impact fees so long as those uses are maintained, and the necessary covenants or declaration of restrictions, in a form approved by the City Attorney and the School District attorney, required to ensure the maintenance of such uses, are recorded on the property;

7. The creation of an accessory dwelling unit shall be exempt from the payment of school impact fees and the creation of an accessory dwelling unit within an existing single family structure shall be exempt from the payment of park impact fees;

8. A single room occupancy dwelling shall be exempt from the payment of school impact fees;

9. A change in use where the increase in trip generation is less than the threshold stated in Section 15.04.040(C), Assessment of Impact Fees shall be exempt from paying transportation impact fees; or

10. Any form of low-income housing occupied by households whose income when adjusted for size, is at or below 80 percent of the area median income, as annually adjusted by the U.S. Department of Housing and Urban Development shall be exempt from paying school impact fees provided that a covenant approved by the school district to assure continued use for low income housing is executed, and that the covenant is an obligation that runs with the land upon which the housing is located and is recorded against the title of the property.

B. With respect to impact fees for parks and transportation, the Director shall be authorized to determine whether a particular development activity falls within an exemption identified in this Section, in any other Section, or under other applicable law. Determinations of the Director shall be in writing and shall be subject to the appeals procedures set forth in OMC Chapter 18.75.

C. With respect to school impact fees, requests for an exemption shall be directed to District No. 111. District No. 111 shall determine whether a particular development activity falls within an exemption identified in this Section, in any other Section, or under other applicable law. District No. 111 shall forward its determination to the Director in writing, and the Director may adopt the determination of District No. 111 and may exempt or decline to exempt a particular development activity, or the Director may make an alternative determination and set forth the rationale for the alternative determination. Determinations of the Director shall be in writing and shall be subject to the appeals procedures set forth in OMC Chapter 18.75.

(Ord. 6607 §1, 2008; Ord. 6342 §1, 2004; Ord. 6224 §3, 2002; Ord. 6164 §1, 2001; Ord. 5490 §5, 1994).

15.04.070 - Credits

A. A feepayer can request that a credit or credits for park and/or transportation impact fees be granted for the total value of dedicated land, improvements, and/or construction provided by the feepayer if the land, improvements, and/or construction facility are identified in the capital facilities plan as projects providing capacity to serve new growth. The Director may make a finding that such land, improvements, and/or facility would serve the goals and objectives of the capital facilities plan. For park and transportation impact fees, the feepayer can also request a credit or credits for significant past tax payments. For each request for a credit or credits for significant past tax payments for park and transportation impact fees, the feepayer shall submit receipts and a calculation of past tax payments earmarked for or proratable to the projects that provide capacity to serve new growth in the capital facilities plan.

B. Where the dedicated land, improvements, and/or construction is for the benefit of District No. 111, the feepayer shall direct the request for a credit or credits to District No. 111. District No. 111 shall first determine the general suitability of the land, improvements, and/or construction for District purposes. Second, District No. 111 shall determine whether the land, improvements, and/or the facility constructed are included within the District’s adopted capital facilities plan or the Board of Directors for District No. 111 may make the finding that such land, improvements, and/or facilities would serve the goals and objectives of the capital facilities plan of District No. 111. District No. 111 shall forward its determination to the Director, including cases where District No. 111 determines that the dedicated land, improvements, and/or construction are not suitable for District purposes. The Director may adopt the determination of District No. 111 and may award or decline to award a credit, or the Director may make an alternative determination and set forth in writing the rationale for the alternative determination.

C. For each request for a credit or credits, if appropriate, the Director shall select an appraiser or the feepayer may select an independent appraiser acceptable to the Director. The appraiser must be a Washington State Certified Appraiser or must possesses other equivalent certification and shall not have a fiduciary or personal interest in the property being appraised. A description of the appraiser’s certification shall be included with the appraisal, and the appraiser shall certify that he/she does not have a fiduciary or personal interest in the property being appraised.

D. The appraiser shall be directed to determine the total value of the dedicated land, improvements, and/or construction provided by the feepayer on a case-by-case basis.

E. Where the dedicated land, improvements, and/or construction is for the benefit of District No. 111 and District No. 111 has determined that the land, improvements, and/or construction would be suitable for District purposes, District No. 111 shall select an appraiser or the feepayer may select an independent appraiser acceptable to District No. 111. Such appraiser must meet and comply with the requirements set forth in subsection C above. The appraiser shall be directed to determine the value of the dedicated land, improvements, or construction provided by the feepayer on a case-by-case basis.

F. The feepayer shall pay for the cost of the appraisal or request that the cost of the appraisal be deducted from the credit which the Director may be providing to the feepayer, in the event that a credit is awarded.

G. After receiving the appraisal, or the determination of District No. 111, and where consistent with the requirements of this Section, the Director shall provide the applicant with a letter or certificate setting forth the dollar amount of the credit, the reason for the credit, the legal description of the site donated where applicable, and the legal description or other adequate description of the project or development to which the credit may be applied. The applicant must sign and date a duplicate copy of such letter or certificate indicating his/her agreement to the terms of the letter or certificate, and return such signed document to the Director before the impact fee credit will be awarded. The failure of the applicant to sign, date, and return such document within sixty (60) calendar days shall nullify the credit. The credit must be used within seventy-two (72) months of the award of the credit.

H. Any claim for credit must be made no later than twenty (20) calendar days after the submission of an application for a building permit.

I. In no event shall the credit exceed the amount of the impact fees that would have been due for the proposed development activity.

J. No credit shall be given for project improvements.

K. Determinations made by the Director pursuant to this Section shall be subject to the appeals procedures set forth in OMC Chapter 18.75.

L. The fee payer may also apply for a credit for transportation demand management strategies. The Director shall determine the actual amount of the credit to be granted to a specific project for the transportation demand management strategies that the feepayer will implement. The Director may consider the possible impacts on adjacent residential parking when considering a request for credit. At the discretion of the Director, eligible projects may reduce transportation impact fees by the following amounts:

|

ACTION |

TRANSPORTATION IMPACT FEE REDUCTION |

|

Operational Improvements: |

|

|

Installation of centralized Transportation Demand Management (TDM) information center with maintained information. |

1% |

|

Commercial development which would be occupied by employees subject to Commute Trip Reduction ordinance or evidence to voluntarily comply with Commute Trip Reduction ordinance. |

3% |

|

Installation of parking spaces which are designated as paid parking (by residents or employees). |

3% |

|

Signage and enforcement designating parking lots to be used for carpool or vanpool parking for non-building occupants. |

1% |

|

Physical Improvements: |

|

|

Construction of direct walkway connection to the nearest arterial. |

1% |

|

Installation of on-site sheltered bus stop, or bus stop within 1/4 mile of site with adequate walkways as determined by Transportation Division staff. |

1% |

|

Installation of bike lockers or employee showers. |

1% |

|

Construction of on-site internal walk/bikeway network which connects to existing City bicycle/pedestrian networks. |

1% |

|

Installation of preferential carpool/vanpool parking facilities. |

2% |

|

Underbuild median parking requirements by at least 20% OR underbuild by at least 30% OR underbuild by at least 40%. |

2% or 4% or 7% |

|

Downtown construction that provides no parking for employees or customers. |

10% |

|

Other: |

|

|

Other operational or physical Transportation Demand Management measures identified by the developer (with supporting documentation). |

Up to 20% based upon peak hour trip reductions |

|

Maximum Reduction |

Up to 20% |

The following guidelines define the conditions under which transportation demand management credits may be granted. The Director shall request documentation or other sureties to ensure the effectiveness and continuation of the impact of these credits.

OPERATIONAL

1. Kiosks must be centrally located transportation information centers in areas of high visibility to employees and customers. The kiosk must contain at least alternative mode, ride share, and flex time information which is updated quarterly or more often.

2. Applicants requesting credit because they will house employers subject to the Commute Trip Reduction (CTR) Act must provide a signed five-year lease or other evidence in a form approved by the City Attorney that obligates the occupants to reduce peak hour trips.

3. Paid parking space credit will be given only if 25% or more of the actual parking stalls are clearly designated and administered as paid parking.

PHYSICAL

1. Bike lockers must designated for be a minimum of three spaces or at least 1% of the actual parking area constructed for the building.

2. "Carpool/vanpool only" parking must be designated for a minimum of three spaces or 15% of the actual constructed parking area.

Transportation Impact Fee Reduction for Underbuilding Median Parking:

1. Any physical/operational improvements required by the City to reduce parking are not eligible for individual TIF reductions.

2. Physical/operational improvements being proposed above and beyond those required for parking reductions are eligible for TIF reductions.

*Plus other possible TDM credits as identified by the applicant which reduces single occupancy vehicle trips.

(Ord. 6607 §1, 2008; Ord. 6224 §4, 2002; Ord. 6164 §1, 2001; Ord. 5490 §6, 1994).

15.04.080 - Tax adjustments

Pursuant to and consistent with the requirements of RCW 82.02.060, the Parks Study, the Transportation Study, and the Schools Study have provided adjustments for future taxes to be paid by the new development which are earmarked or proratable to the same new public facilities which will serve the new development. The impact fee schedules in Appendix A (Chapter 15.16) have reasonably adjusted for taxes and other revenue sources which are anticipated to be available to fund these public improvements.

(Ord. 6607 §1, 2008; Ord. 6224 §5, 2002; Ord. 6164 §1, 2001; Ord. 5490 §7, 1994).

15.04.090 - Appeals

A. Any feepayer may pay the impact fees imposed by this title under protest in order to obtain a building permit or occupancy permit. No appeal shall be permitted until the impact fees at issue have been paid.

B. Appeals regarding the impact fees imposed on any development activity shall only be filed by the feepayer of the property where such development activity will occur, except as otherwise provided herein (See Subsection E).

C. The feepayer must first file a request for review regarding impact fees with the Director, as provided herein:

1. The request shall be in writing on the form provided by the City;

2. The request for review by the Director shall be filed no later than fourteen (14) calendar days after the feepayer pays the impact fees at issue;

3. No administrative fee will be imposed for the request for review by the Director; and

4. The Director shall issue a determination in writing.

D. Determinations of the Director with respect to the applicability of the impact fees to a given development activity, the availability or value of a credit, or the Director’s decision concerning the independent fee calculation, or any other determination which the Director is authorized to make pursuant to this title, can be appealed to the hearing examiner subject to the procedures set forth in OMC Chapter 18.75.

E. If the Director makes a determination on an adjustment, credit, or independent fee calculation contrary to or inconsistent with the determination or analysis prepared by District No. 111, District No. 111 may appeal the Director’s determination to the hearing examiner subject to the procedures set forth in OMC Chapter 18.75.

(Ord. 6607 §1, 2008; Ord. 6224 §6, 2002; Ord. 6164 §1, 2001; Ord. 5594 §16, 1996; 5570 §7, 1996; 5490 §8, 1994).

15.04.100 - Establishment of impact fee accounts for parks and transportation

A. Impact fee receipts shall be earmarked specifically and deposited in special interest-bearing accounts. The fees received shall be invested in a manner consistent with the investment policies of the City.

B. There are hereby established two separate impact fee accounts for the fees collected pursuant to this title: the Parks Impact Account and the Transportation Impact Account. Funds withdrawn from these accounts must be used in accordance with the provisions of Section 15.04.130 of this title. Interest earned on the fees shall be retained in each of the accounts and expended for the purposes for which the impact fees were collected.

C. On an annual basis, the Financial Director shall provide a report to the Council on each of the two impact fee accounts showing the source and amount of all moneys collected, earned, or received, and the public improvements that were financed in whole or in part by impact fees.

D. Impact fees shall be expended or encumbered within six (6) years of receipt, unless the Council identifies in written findings extraordinary and compelling reason or reasons for the City to hold the fees beyond the six (6) year period. Under such circumstances, the Council shall establish the period of time within which the impact fees shall be expended or encumbered.

(Ord. 6607 §1, 2008; Ord. 6164 §1, 2001; Ord. 5490 §9, 1994).

15.04.110 - Authorization for the school interlocal agreement and the establishment of the school impact account

A. The City Manager is authorized to execute, on behalf of the City, an interlocal agreement for the collection, expenditure, and reporting of school impact fees; provided that, such interlocal agreement complies with the provisions of this Section.

B. As a condition of the interlocal agreement, District No. 111 shall establish a School Impact Account with the Office of the Thurston County Treasurer, who serves as the Treasurer for District No. 111. The account shall be an interest-bearing account, and the school impact fees received shall be invested in a manner consistent with the investment policies of District No. 111.

C. For administrative convenience while processing the fee payments, school impact fees may be temporarily deposited in a City account, with interest earned retained by the City. As soon as practicable, the City shall transmit the school impact fees collected for District No. 111 to District No. 111. District No. 111 shall deposit the fees in the School Impact Account established by the District.

D. Funds withdrawn from the School Impact Account for District No. 111 must be used in accordance with the provisions of Section 15.04.130 of this title. The interest earned shall be retained in this account and expended for the purposes for which the school impact fees were collected.

E. On an annual basis, pursuant to the interlocal agreement, District No. 111 shall provide a report to the Council on the School Impact Account, showing the source and amount of all monies collected, earned, or received, and the public improvements that were financed in whole or in part by impact fees.

F. School impact fees shall be expended or encumbered within six (6) years of receipt, unless the Council identifies in written findings extraordinary and compelling reason or reasons for District No. 111 to hold the fees beyond the six (6) year period. Under such circumstances, the Council shall establish the period of time within which the impact fees shall be expended or encumbered, after consultation with District No. 111.

(Ord. 6607 §1, 2008; Ord. 6164 §1, 2001; Ord. 5490 §10, 1994).

15.04.120 - Refunds

A. If the City or District No. 111 fails to expend or encumber the impact fees within six (6) years of when the fees were paid, or where extraordinary or compelling reasons exist, such other time periods as established pursuant to Sections 15.04.100 or 15.04.110, the current owner of the property on which impact fees have been paid may receive a refund of such fees. In determining whether impact fees have been expended or encumbered, impact fees shall be considered expended or encumbered on a first in, first out basis.

B. The City shall notify potential claimants by first class mail deposited with the United States Postal Service at the last known address of such claimants. The potential claimant must be the owner of the property for which the impact fee was paid.

C. Current owner(s) seeking a refund of impact fees must submit a written request for a refund of the fees to the Director and/or District No. 111 within one (1) year of the date the right to claim the refund arises or the date that notice is given, whichever is later.

D. Any impact fees for which no application for a refund has been made by the claimant within this one-year period shall be retained by the City or District No. 111 and expended on the appropriate public facilities. Claimants shall have no rights to a refund if not timely requested pursuant to Subsection 15.04.120(C).

E. Refunds of impact fees under this Section shall include any interest earned on the impact fees by the City or District No. 111.

F. When the City seeks to terminate any or all components of the impact fee program, all unexpended or unencumbered funds from any terminated component or components, including interest earned, shall be refunded pursuant to this Section. Upon the finding that any or all fee requirements are to be terminated, the City shall place notice of such termination and the availability of refunds in a newspaper of general circulation at least two (2) times and shall notify all potential claimants by first class mail at the last known address of the claimants. All funds available for refund shall be retained for a period of one (1) year. At the end of one (1) year, any remaining funds shall be retained by the City, but must be expended for the appropriate public facilities. This notice requirement shall not apply if there are no unexpended or unencumbered balances within the account or accounts being terminated.

G. The City shall also refund to the current owner of property for which impact fees have been paid all impact fees paid, including interest earned on the impact fees, if the development activity for which the impact fees were imposed did not occur; provided that, if the City or District No. 111 has expended or encumbered the impact fees in good faith prior to the application for a refund, the Director or District No. 111 can decline to provide the refund. If within a period of three (3) years, the same or subsequent owner of the property proceeds with the same or substantially similar development activity, the owner can petition the Director or District No. 111 for an offset against the actual impact fee amounts paid. The petitioner must provide receipts of impact fees previously paid for a development of the same or substantially similar nature on the same property or some portion thereof. In the case of park or transportation impact fees, the Director shall determine whether to grant an offset, and the determinations of the Director may be appealed pursuant to the procedures in OMC Chapter 18.75. In the case of school impact fees, District No. 111 shall determine whether to grant an offset. District No. 111 shall forward its determination to the Director, and the Director may adopt the determination of District No. 111 and may grant or decline to grant an offset, or the Director may make an alternative determination and set forth the rationale for the alternative determination. Determinations of the Director shall be in writing and shall be subject to the appeals procedures set forth in OMC Chapter 18.75.

(Ord. 6607 §1, 2008; Ord. 6224 §7, 2002; Ord. 6164 §1, 2001; Ord. 5490 §11, 1994).

15.04.130 - Use of funds

A. Pursuant to this title, impact fees:

1. shall be used for public improvements that will reasonably benefit the new development; and

2. shall not be imposed to make up for deficiencies in public facilities serving existing developments; and

3. shall not be used for maintenance or operation.

B. With respect to parks facilities, impact fees may be spent for public improvements, including, but not limited to, planning for parks that will reasonably benefit the new development, land acquisition, site improvements, necessary off-site improvements, construction, engineering, architectural, permitting, financing, and administrative expenses, applicable impact fees or mitigation costs, and capital equipment pertaining to park facilities.

C. Transportation impact fees may be spent for public improvements, including, but not limited to, planning, land acquisition, right-of-way acquisition, site improvements, necessary off-site improvements, construction, engineering, architectural, permitting, financing, and administrative expenses, applicable impact fees, or mitigation costs, and any other expenses which can be capitalized pertaining to transportation improvements.

D. With respect to schools, impact fees may be spent for public improvements, including, but not limited to, school planning, land acquisition, site improvements, necessary off-site improvements, construction, engineering, architectural, permitting, financing, and administrative expenses, applicable impact fees or mitigation costs, capital equipment pertaining to educational facilities, and any other expenses which can be capitalized.

E. Impact fees may also be used to recoup public improvement costs previously incurred by the City or District No. 111 to the extent that new growth and development will be served by the previously constructed improvements or incurred costs.

F. In the event that bonds or similar debt instruments are or have been issued for the advanced provision of public improvements for which impact fees may be expended, impact fees may be used to pay debt service on such bonds or similar debt instruments to the extent that the facilities or improvements provided are consistent with the requirements of this Section and are used to serve the new development.

(Ord. 6607 §1, 2008; Ord. 6164 §1, 2001; Ord. 5490 §12, 1994).

15.04.140 - Administrative guidelines

The Director shall be authorized to adopt forms, applications, brochures, and guidelines for the implementation of this title which may include the adoption of a procedures guide for impact fees.

(Ord. 6164 §1, 2001; Ord. 5490 §13, 1994).

15.04.150 - Review

The fee schedules set forth in Chapter 15.16 shall be reviewed by the Council as it may deem necessary and appropriate in conjunction with the annual update of the capital facilities plan element of the City’s comprehensive plan.

(Ord. 6164 §1, 2001; Ord. 5490 §14, 1994).